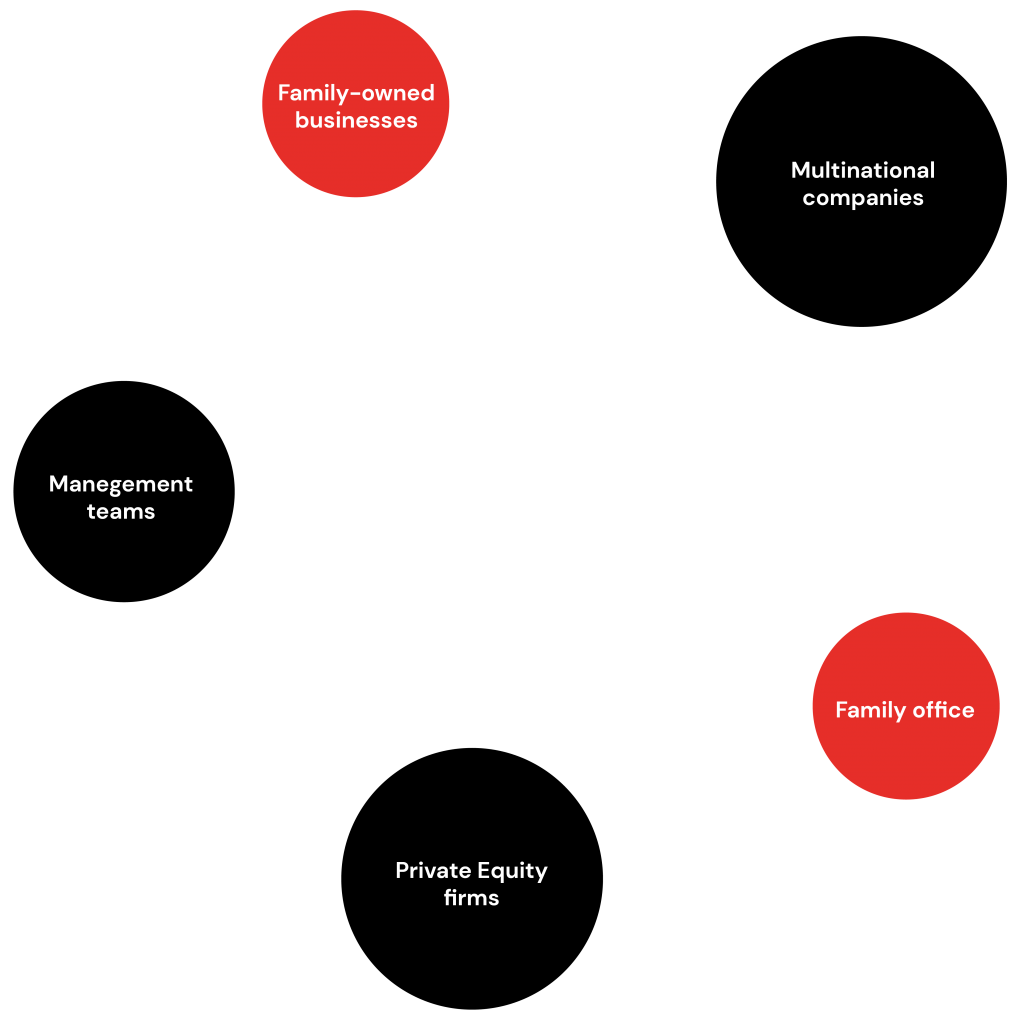

We offer our clients advisory services in both transactions and corporate strategies, understanding these as operations that have an impact on the company’s capital, its strategy, or its business development.

Strategic alliances

Fundraising for acquisitions

Analysing and procuring bank and alternative financing

Contact us

VALENCIA · MADRID · ALICANTE

© Highland Corporate 2024 · web joanrojeski estudi creatiu

VALENCIA · MADRID · ALICANTE

© Highland Corporate 2024 · web joanrojeski estudi creatiu

Bienvenida/o a la información básica sobre las cookies de la página web responsabilidad de la entidad:

HIGHLAND FINANZAS CORPORATIVAS, S.L

Una cookie o galleta informática es un pequeño archivo de información que se guarda en tu ordenador, “smartphone” o tableta cada vez que visitas nuestra página web. Algunas cookies son nuestras y otras pertenecen a empresas externas que prestan servicios para nuestra página web.

Las cookies pueden ser de varios tipos: las cookies técnicas son necesarias para que nuestra página web pueda funcionar, no necesitan de tu autorización y son las únicas que tenemos activadas por defecto.

El resto de cookies sirven para mejorar nuestra página, para personalizarla en base a tus preferencias, o para poder mostrarte publicidad ajustada a tus búsquedas, gustos e intereses personales. Puedes aceptar todas estas cookies pulsando el botón ACEPTAR, rechazarlas pulsando el botón RECHAZAR o configurarlas clicando en el apartado CONFIGURACIÓN DE COOKIES.

Si quieres más información, consulta la POLÍTICA DE COOKIES de nuestra página web.